Under the provisions of Section 1712 of the CGST Act 2017 read with Rule 133 the Authority finds that commensurate reduction in the price of the goods has not been effected by the Respondent after the GST rates were reduced vide Notification No 412017 Central. If the supplier has paid the tax on the goodsservices ITC will be allowed to the.

After filling of form GSTR-3 by both supplier and recipient system carries out the matching process.

. The GST is set to increase from the current 7 per cent to 8 per cent in January 2023 and to 9 per cent in January 2024. The Inland Revenue Board of Malaysia LHDN has announced a change in its contact number for its Hasil Care Line HCL effective 16 May 2019. Therefore if the gross income is related to the work performed outside Malaysia and the taxpayer wishes to treat it as foreign source income the taxpayer would need to substantiate that it is attributable to operations of.

EVENT CALENDAR Check out whats happening. ClearTax GST with its powerful billing vendor data mismatch reconciliation mechanism validation engines and return filing process serves as a single platform for all GST compliance. Earlier it was not possible to claim input tax credit for Central Sales Tax Entry Tax Luxury Tax and other taxes.

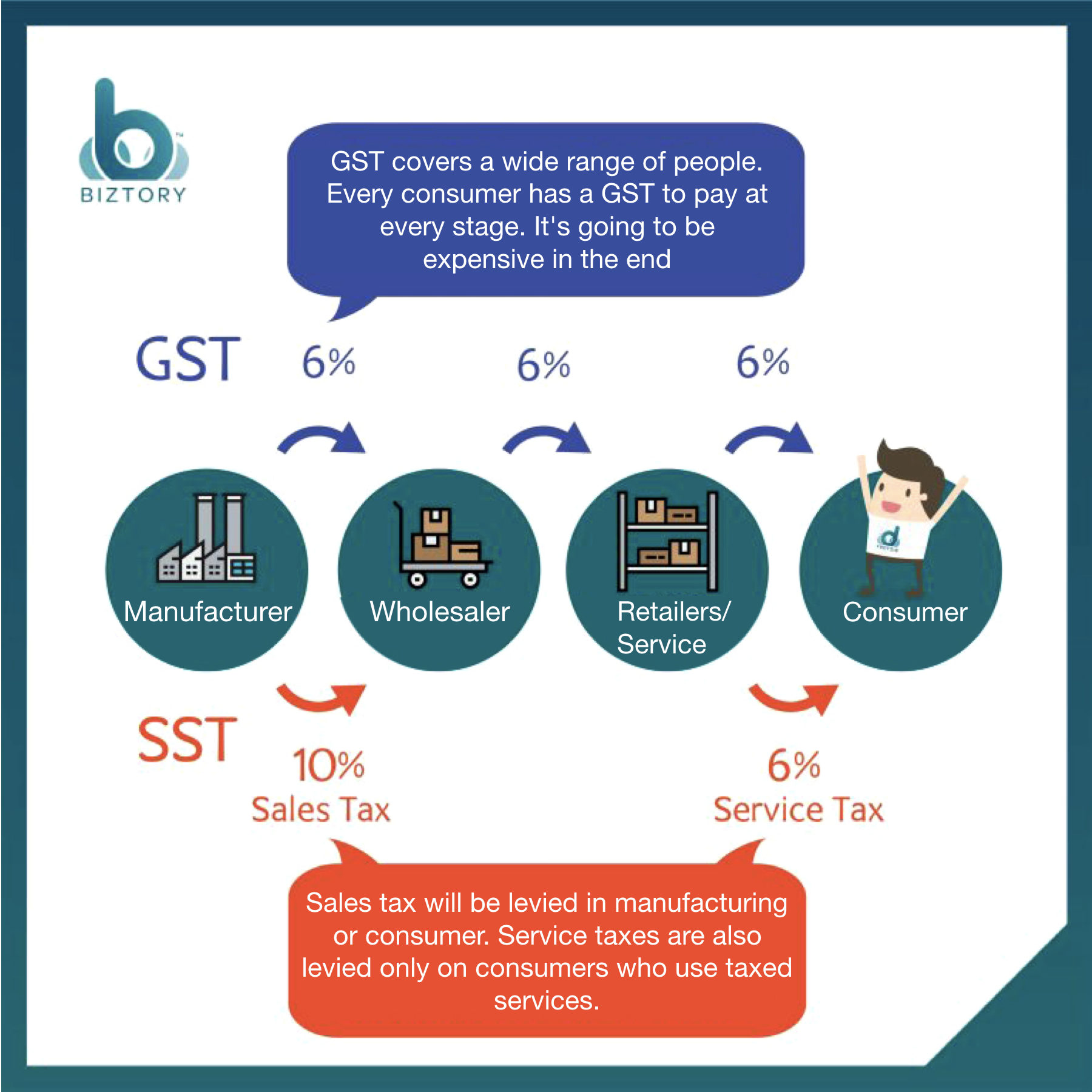

NAA NAA held that a. Sales and Service Tax SST in Malaysia. COMPLAINT.

Under the GST Application to Government Order 2014 the following. Human Resources. Wong who is also Deputy Prime Minister was responding to questions posed by various Members of Parliament MPs on whether the government was considering postponing the GST hike given the global downturn and soaring inflation.

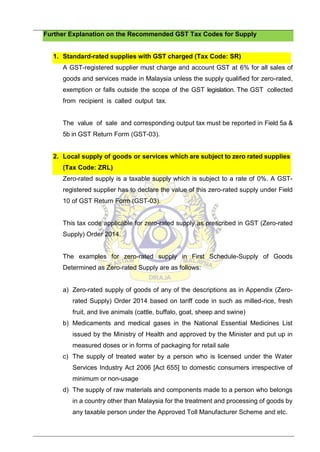

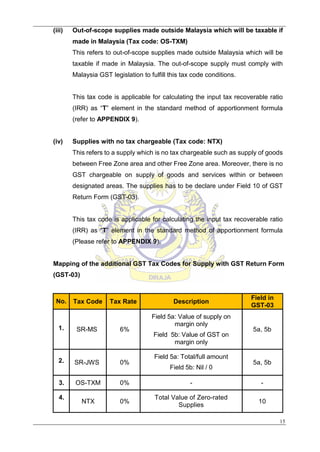

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Out of the total projected agritech market potential of US24 billion the supply chain technology and output markets segments have the highest potential in India worth US121 billion followed by financial services US41 billion precision agriculture and farm management US34 billion quality management and. Governments are treated as out of scope supplies unless the supplies are specified in the GST Application to Government Order 2014.

Growing segments within agritech in India. Goods and Services Tax GST Industry Guide. Any goods imported is subject to sales tax unless an exemption is claimed by the manufacturer under item 54 Schedule A of the Sales Tax Person Exempted from Payment of Tax Order 2018.

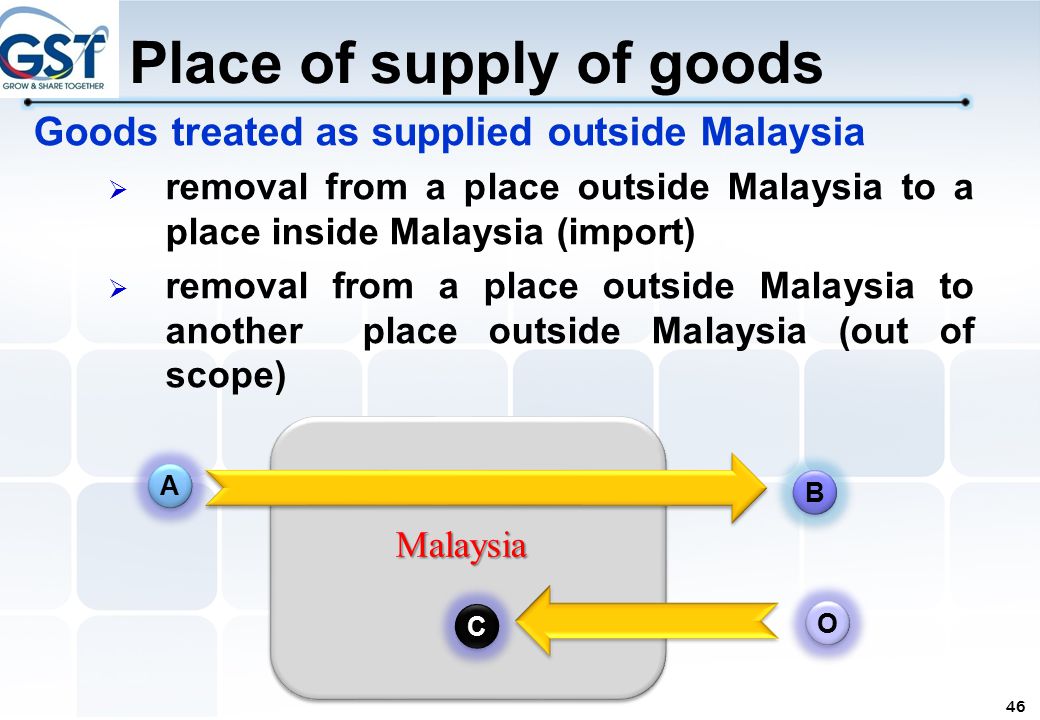

Director General of Anti-Profiteering Vs LOreal India Pvt. Importation of goods into Malaysia. Goods returned to the manufacturer in FZ is as if such goods are exported from Malaysia to a place outside Malaysia under.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. Now its scope has been widened under GST. AGENCY Browse other government agencies and NGOs websites from the list.

The scope is wider than merely to treat gross income that is attributable to business operations carried on in Malaysia. You can create 100 GST complaint bills or bulk import sales and purchase data from your accounting software such as Tally in excel format. The Enlarged Scope of SST Malaysia.

The term out of scope means that the supplies are not within the ambit of the GST Act 2014 and are therefore not subject to GST.

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download

Gst Tax Codes Rates Myobaccounting Com My

Overview Of Goods And Services Tax Gst In Malaysia

An Introduction To Malaysian Gst Asean Business News

Malaysian Royal Customs Department Guide On Gst Accounting Software

Basic Concepts Of Gst Goods Services Tax Goods Services Tax Gst Malaysia Nbc Group

Session Malaysias New Gst Business Change With Tax

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysian Royal Customs Department Guide On Gst Accounting Software

Gst Malaysia Gst Treatment Disbursement Reimbursement Facebook By Gst Malaysia Gst Treatment Disbursement Reimbursement Recovery Of Expenses 1 Invoice In Own Company Name Reimbursement 6 Gst 2 Invoice In Client S Name

Overview Of Goods And Services Tax Gst In Malaysia

Goods And Services Tax Gst Is A Broad Based Consumption Tax Levied On The Import Of Goods Collected By Singapore Customs As Well As Nearly All Supplies Of Goods And Services In Singapore

Malaysian Royal Customs Department Guide On Gst Accounting Software

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download